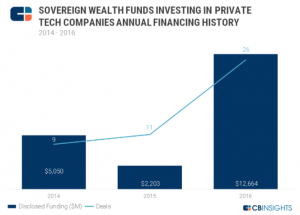

According to CB Insights, Sovereign Wealth Funds (SWFs), which are government-owned investments, have become technology investors with increasing holdings. With the great smart technology boom in the late 2000s, investors left and right have been jumping at the chance to get their piece of the pie in technology, and SWFs have followed suit.

A large portion of my clients when I was in Fixed Income Sales were SWFs – some of the world’s largest. I like hearing about their investments in less traditional assets, as historically they were always considered rather conservative investors. Sometimes it’s difficult to ascertain in what areas SWFs are the most active. CB Insights put together a database of all sovereign wealth investments made in private technology companies since 2010. The end result was a business social graph that displayed an intricate web of information. However, the greatest takeaway the graph highlights is the ten most active sovereign wealth funds that invest in private tech companies.

It turns out that the top investor in the whole world is Bpifrance which was set up in 2009. They are not that large relative to other SWFs so it’s interesting to note their investment size in this sector. The second and third most active funds, Temasek Holdings and GIC, respectively, are located in Singapore. I wasn’t surprised to see Temasek and GIC’s name in the top given their sheer size and what I recall of their diverse and savvy investment portfolios.

To see the rest of the world’s top 10 sovereign health funds, read CB Insights’ blog here.